A great story can make all the difference.

Let’s tell yours.

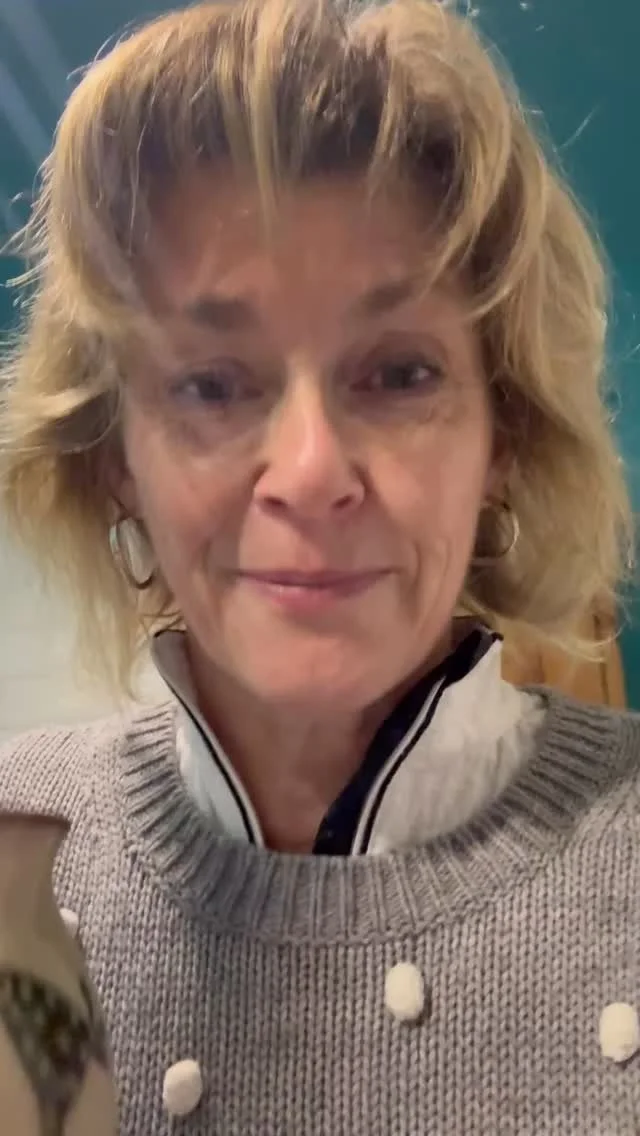

Hi, I’m Nicky.

I’m a writer and broadcaster, event host and life coach, based in the Highlands. I’m also a Registered Humanist Celebrant , conducting legal weddings and civil partnerships, and heartfelt funerals too. All my work relies on clear communication.

For a good few years, I’ve coached people (online and face-to-face) helping them to plot new routes, take brave risks, and step up to take for the life they deserve.

Everyone (and every business) has a story. Sometimes it’s in the past, other times it’s just around the corner. And sharing it can be the most inspiring and fulfilling experience.

Let me help you with that.

I enjoy supporting people to get from where they are now, to where they’d love to be.

People want to buy from purpose-driven people who they like. Let me help tell your business story.

Presenting needn’t be scary, but if it is, I can help you harness your fear to enhance your performance.

TV? Radio? Press? My media training will help you stay on-message and on-brand, whether it’s good news or bad, celebration or crisis.

I create professional peer-support groups that can help you unlock change in yourself and in your workplace.

Being there to help families mark and celebrate life’s milestones is a privilege. I am registered to conduct legal weddings and civil partnerships in Scotland, and to help families say good goodbyes at funerals too.

My early career as a broadcaster and journalist helps me front your conference, awards ceremony, or dinner, holding an audience, celebrating your success, and bringing it all to life for maximum effect.

I’m happy to lend my voice and script-writing skills for ad campaigns and corporate videos.